Market Context

The market was trending during the session but showed sharp intraday reversals around key investor levels. This created multiple opportunities on both sides, provided entries were taken strictly according to structure and strike selection rules.

Trade 1 – Call Option Short (Trend Trade)

I started by trading in the direction of the prevailing trend and shorted a call option strictly according to my setup and rules.

However, the market reversed briefly and hit my stop loss before continuing in the original direction.

This was a normal stop-out and part of the system.

Trade 2 – Re-Entry with Different Strike (Profitable)

After the trend resumed, I re-entered using a different strike based on my criteria.

This trade worked and reached profit.

Later, I realised that I had made an execution mistake while placing the risk-reward levels. Because of the wrong placement, the trade closed at 3.25R instead of the intended 3R.

The profit was already booked by the time I noticed it.

Although the result was positive, this is still something I need to correct, because consistency in execution matters more than accidental extra profit.

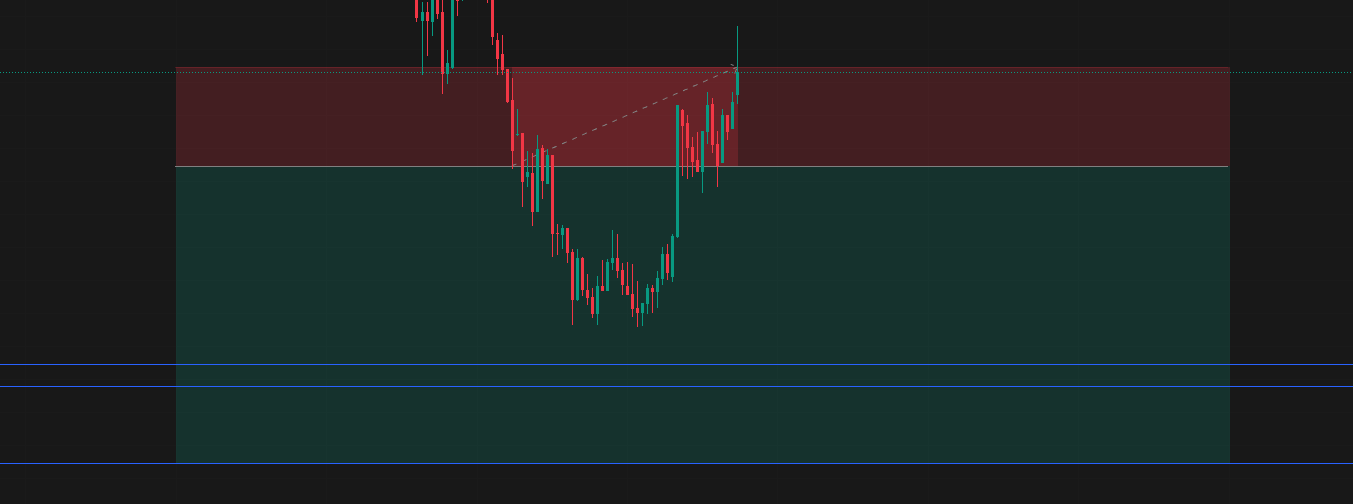

Trade 3 – Put Option Short from Investor Levels

Soon after, the market reversed sharply from important investor levels and offered a valid recovery-side opportunity.

I shorted a put option based on:

- Structure

- Strike selection rules

- Momentum confirmation

The move started well and came very close to my trailing profit target, missing it by only a few points.

Then the market reversed again and hit my full stop loss.

Psychological Moment – Choosing Rules Over Comfort

During that reversal, I felt a strong urge to exit early to avoid taking the full stop loss.

But doing that would have broken my rules.

I stopped myself.

If I allow myself to break rules once, it becomes easier to justify it again in the future. That is how discipline slowly disappears and emotional trading begins.

I accepted the full stop loss because protecting my process is more important than protecting a single trade.

Key Takeaways from Today

- A stop loss does not mean the setup was wrong.

- Re-entries are valid if structure and rules still align.

- Risk-reward placement must be precise, even on winning trades.

- Discipline is more valuable than saving one losing trade.

Final Thoughts

Today included:

- One stop loss

- One profitable re-entry

- One execution mistake

- One losing trade

- And one important psychological decision

The result of a single day does not matter.

What matters is executing the same process, the same rules, and the same discipline every day.

That is where long-term consistency comes from.