Today’s trading session was a reminder that following rules does not guarantee profits every day—but it does guarantee survival. I executed two trades, both strictly according to my predefined intraday options trading system. One resulted in a stop-loss, and the other ended at breakeven.

Market Context

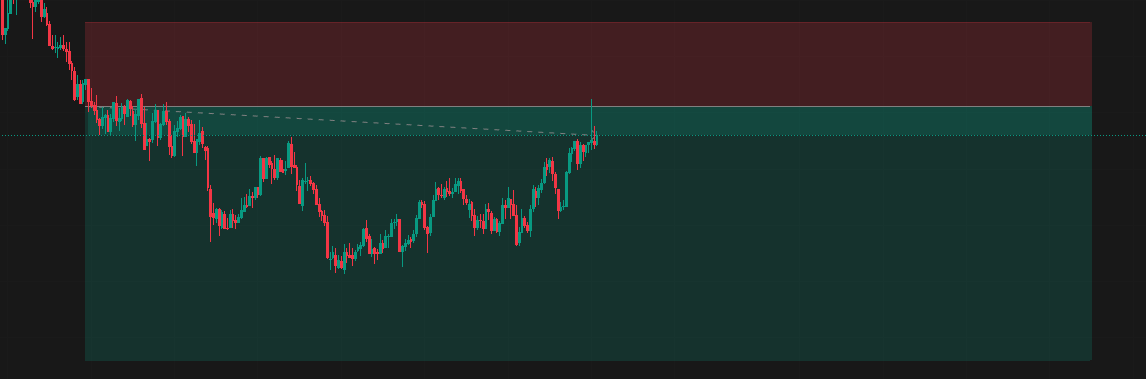

The market opened with a small gap down and initially showed signs of recovery from the lows. However, throughout the session, price action remained indecisive, rotating around the same levels without sustained momentum in either direction.

This type of environment often produces valid setups that fail to follow through—exactly what happened today.

Trade 1: Put Option Short — Stop-Loss Hit

After the early recovery from the opening dip, the market presented a valid setup to short the PUT option based on my rules. Structure, timing, and price behaviour aligned well enough to justify the entry.

Unfortunately, the move failed to sustain. The market stalled, reversed, and eventually hit my predefined stop-loss.

There was no hesitation, no adjustment, and no emotional response. The stop-loss existed for this exact scenario and did its job.

Trade 2: Call Option Short — Breakeven Exit

Following the stop-loss, the market moved into a prolonged consolidation phase around the same price zone. Later in the session, a valid setup appeared on the CALL side.

I executed the trade as per plan. Initially, price moved in my favour, but the momentum was clearly limited. It never showed the strength required to reach my 3R target—or even 2.5R.

As per my rules, once 30 minutes had passed without sufficient follow-through, I moved my stop-loss to breakeven.

The market later reversed and took me out at breakeven.

Execution and Rule Adherence

- Both trades were valid setups

- Risk was predefined and respected

- No impulsive entries or exits

- No revenge trades

- Maximum trades per day rule followed

This is exactly how a professional trading day looks—even when profits don’t show up.

Key Takeaway

Not every valid setup leads to a profitable outcome. Some days, the market simply does not provide enough range or momentum to pay for risk.

What matters is consistency in execution, not forcing results.

A stop-loss is not failure. A breakeven trade is not wasted effort. Both are signs of discipline in a non-trending market.

Final Thoughts

Days like these test patience more than skill. The real edge in trading comes from showing up, executing the plan, and accepting outcomes without emotional interference.

Capital is preserved. Rules are intact. Tomorrow is another trading day.