Today’s session was a good reminder that trending markets do not always move fast. Sometimes they move slowly, overlapping price, retesting levels, and quietly transferring money from impatient traders to disciplined option sellers.

Market Overview

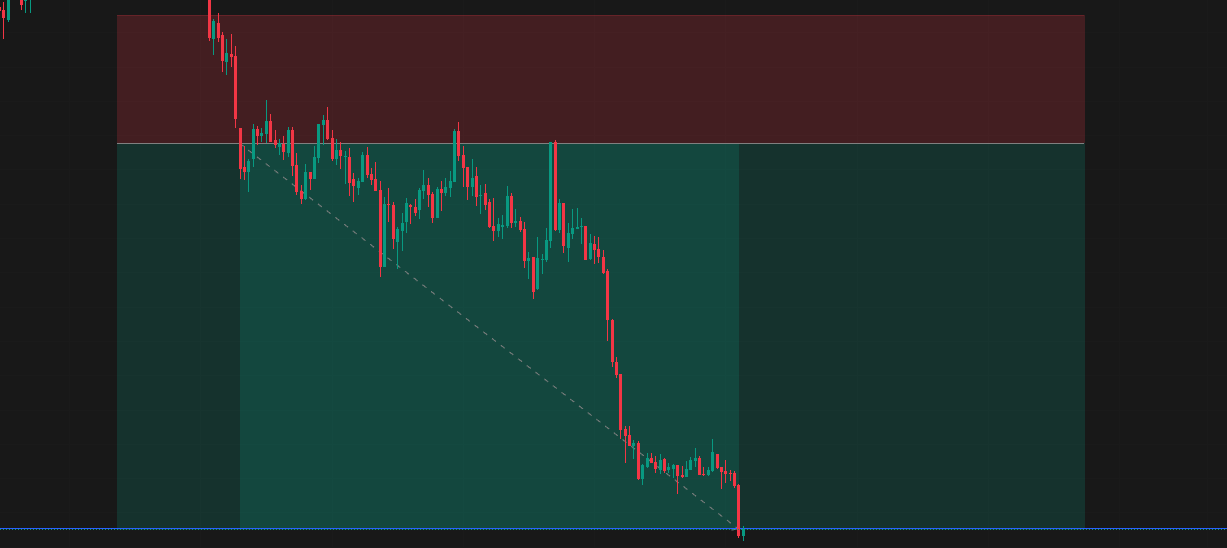

The market opened weak and bearish sentiment dominated the early part of the session. Most participants reacted in the same way — aggressive call-shorting and put-buying.

Price action appeared directional, with the index trending lower.

However, instead of clean momentum, every push was followed by a pullback. Every breakdown was retested. The market kept forming overlapping structures and rotating around newly created levels.

This type of slow trending environment with repeated retests is dangerous for option buyers but ideal for a structured option selling strategy.

Why Option Buyers Struggled

Although direction was correct, momentum never expanded.

- Pullbacks kept resetting emotions

- Breakdowns failed to extend immediately

- Premiums lost value during every pause

- Theta decay worked continuously against long positions

Many traders were right on direction but wrong on timing. Each retest invited time decay, slowly draining option premiums while price moved only marginally.

My Trading Plan

I did nothing during the open.

My intraday trading journal rules remain simple:

- No trading during emotional volatility

- No chasing breakouts

- No reacting to sentiment

- Only trade confirmed structure

The system waits for compression, stability, and controlled movement.

The Setup

The first half of the session offered no valid opportunity. Price was overlapping too much and structure was still forming.

The setup appeared in the second half:

- Price consolidated tightly

- Buyers defended structure repeatedly

- Downside momentum weakened

- Option premiums were already inflated earlier

This aligned cleanly with my option selling strategy rules.

Trade Execution

The execution was mechanical:

- Risk predefined

- Stop loss fixed

- Position size unchanged

- No interference after entry

Price continued to move slowly in the expected direction while constantly retesting levels.

Buyers absorbed supply at every meaningful zone, preventing volatility expansion. That absorption protected my position while theta decay kept reducing premium value.

The trade reached its target without any adjustment.

Result

Target achieved.

One trade.

No over-trading.

No emotional decisions.

Lessons from Today’s Intraday Trading Journal

- Trending does not mean fast

- Repeated retests destroy option buyers

- Structure beats sentiment

- Rules matter more than confidence

- Option selling requires patience, not prediction

Final Thoughts

This session rewarded discipline.

Not because the market was easy — but because the process was respected.

The rules filtered noise.

The structure provided clarity.

The system controlled risk.

And the outcome followed naturally.

Intraday Trading Journal by MyTradingDesk – Real execution. Real structure. No noise.