In the world of trading, executing a re-entry strategy can be a crucial component of success. Whether you are a seasoned trader or just starting out, understanding market trends, profit targets, and precision trading rules is essential for maximizing your profits and minimizing your losses.

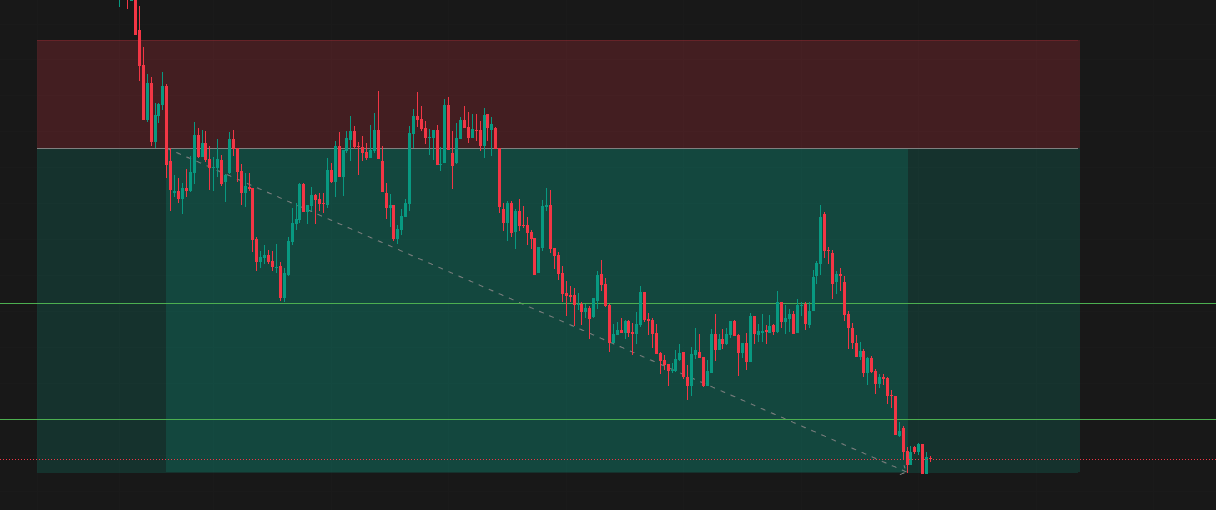

Market trends play a significant role in determining when to re-enter a trade. By analyzing the direction of the market, you can identify potential entry points that align with the overall trend. For example, if the market is in an uptrend, you may look for opportunities to re-enter a trade when the price pulls back to a key support level. Conversely, if the market is in a downtrend, you may wait for a bounce off a resistance level before re-entering a trade.

Profit targets are another important consideration when executing a re-entry strategy. Setting realistic profit targets based on your risk tolerance and trading style can help you lock in gains and avoid giving back profits. By identifying key levels of support and resistance, you can establish profit targets that align with the potential price movement of the asset.

Precision trading rules are essential for maintaining discipline and consistency in your trading approach. By establishing clear entry and exit criteria, you can avoid emotional decision-making and stick to your trading plan. This may include using technical indicators, chart patterns, or other tools to confirm your entry and exit points.

To illustrate the importance of executing a re-entry strategy, let's consider a hypothetical scenario. Imagine you are trading a stock that has been trending higher for several weeks. After entering a long position and capturing a portion of the price movement, the stock begins to pull back. Instead of panicking and selling at a loss, you decide to wait for a re-entry opportunity.

After analyzing the market trends and identifying key support levels, you notice that the stock has bounced off a major support level and is showing signs of strength. With a clear profit target in mind, you re-enter the trade at a favorable price and ride the next leg of the uptrend. By following your precision trading rules and sticking to your plan, you are able to capitalize on the market's movement and achieve your profit target.

In conclusion, executing a re-entry strategy requires a combination of market analysis, profit targets, and precision trading rules. By understanding market trends, setting realistic profit targets, and following a disciplined approach, you can increase your chances of success in the trading world. Remember to stay patient, stay focused, and stay disciplined in your trading decisions. With practice and experience, you can develop a re-entry strategy that works for you and helps you achieve your trading goals.