Today’s session was a classic example of how a rule-based system performs under uncertain market conditions. The market initially showed no clear direction, continuously printing higher highs and lower lows. This created a sideways, indecisive price action phase that can often trap discretionary traders.

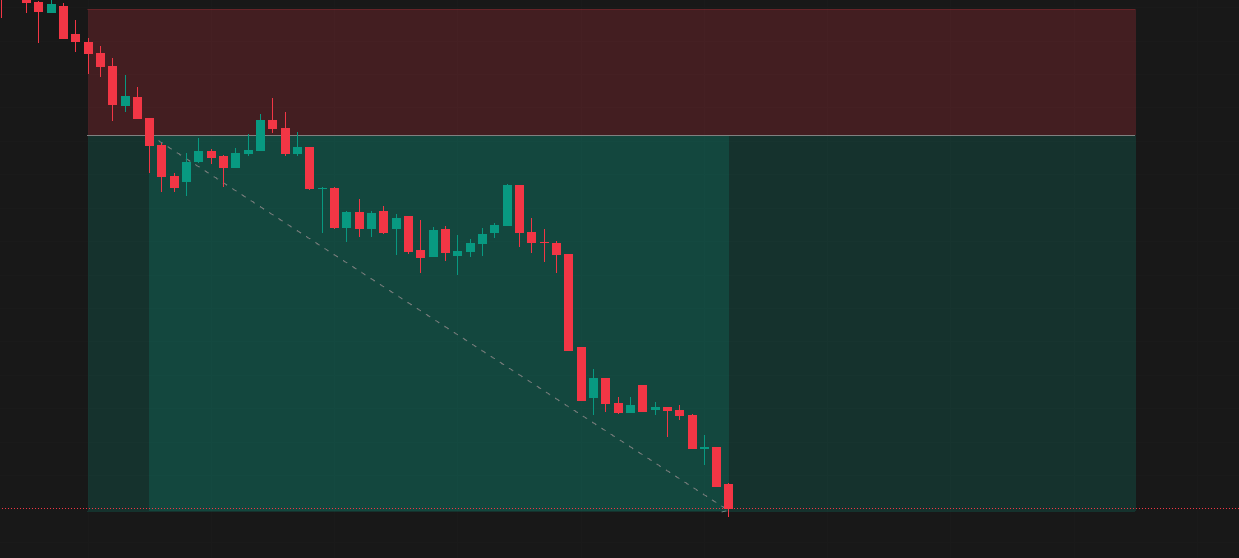

Instead of forcing a view, I observed the structure and let the market reveal itself. Price entered a sustained consolidation phase, respecting key levels without showing a definitive breakout. Eventually, that consolidation broke down — and crucially, it did so in perfect alignment with my predefined setup rules.

Market Structure and Initial Observations

The key to today’s execution was patience. The session lacked directional clarity for an extended period, which is common in choppy markets where participants are balancing risk and reward without conviction. Higher highs and lower lows indicated a lack of commitment from both sides, so no trade was taken early.

As the consolidation progressed, I maintained my focus on structure and rule definitions. I was only looking for a clean trigger that met every condition in my system — entry criteria, risk parameters, and pattern confirmation.

Execution in Line With Rules

Once the consolidation broke down, all setup conditions were satisfied. Based on my rules, I initiated a short position by selling an in-the-money (ITM) call option. Choosing an ITM strike was intentional — it provided enough room for price to move and increased the likelihood of the trade reaching its full profit potential.

Unlike discretionary entries that rely on feel or emotion, this execution was purely mechanical: the breakdown, trigger confirmation, and risk placement were in strict accordance with the system. There was no need to second-guess or adjust behavior mid-trade.

Trade Management and Outcome

Once filled, the trade unfolded exactly as the setup projected. Price moved downward efficiently, with minimal retracement. There was no need for real-time tinkering or micro-management — the rules were already in place, and the market simply played out the probability distribution as expected.

The trade hit the predefined 3R target cleanly. At 3 times the defined risk, the position closed with a favourable outcome and without stress. This type of execution — calm, systematic, and precise — is the hallmark of a robust approach in intraday environments where noise often misleads less disciplined traders.

Reflection and Key Lessons

This session reinforced two core principles that are central to my trading philosophy:

- Discipline over Prediction – The market does not need to be predicted; it only needs to be observed and responded to according to rules.

- Executed Plans Outperform Opinions – A plan executed consistently will outperform ad-hoc decision making over time.

Not every trade will be as clean or as effortless as today’s. However, the value of having a tested rule set becomes clear in sessions like these. When price respects structure and follows your predefined conditions, the market becomes predictable in the sense of probability — not certainty.

For traders committed to consistency, the takeaway is simple: focus on your rules, respect market structure, and let the process lead the outcome. Short-term price noise will always exist, but a disciplined system turns that noise into opportunity.

Today’s result was not about luck. It was the direct consequence of patience, structure, and disciplined execution — the pillars of consistent trading success.