No Guesswork Left: Tagged, Tested, and Tracked.

Join a journey built on discipline, resilience, and real-world performance.

Why Becoming a Full-Time Trader Is No Easy Feat. ↓

Markets

Selecting trading markets is challenging due to diverse asset types, unique market dynamics.

Strategies

Backtesting

Capital Management

Effective capital management in trading involves risk assessment, position sizing, diversification, consistent monitoring, and strategic allocation to maximize returns and minimize losses.

Risk Management

Effective risk management in trading involves setting stop-loss orders and limiting risk exposure to a specific percentage of total capital.

Setup Execution

Effective setup execution in trading entails precise entry and exit points, position sizing, market analysis, risk control, and timely order execution.

Stop-loss Placement

Stop-loss placement in trading ensures risk mitigation by determining predetermined exit points, limiting losses, and safeguarding trading capital. Always use a stoploss!

Risk to reward

Effective risk-to-reward ratio in trading involves evaluating potential profit versus loss, setting target gains, limiting losses, and optimizing trade outcomes to become profitable trader.

Trade Management

Trade management involves timely monitoring, adjusting stop-losses, setting profit targets, managing risk, and ensuring disciplined execution for optimal results

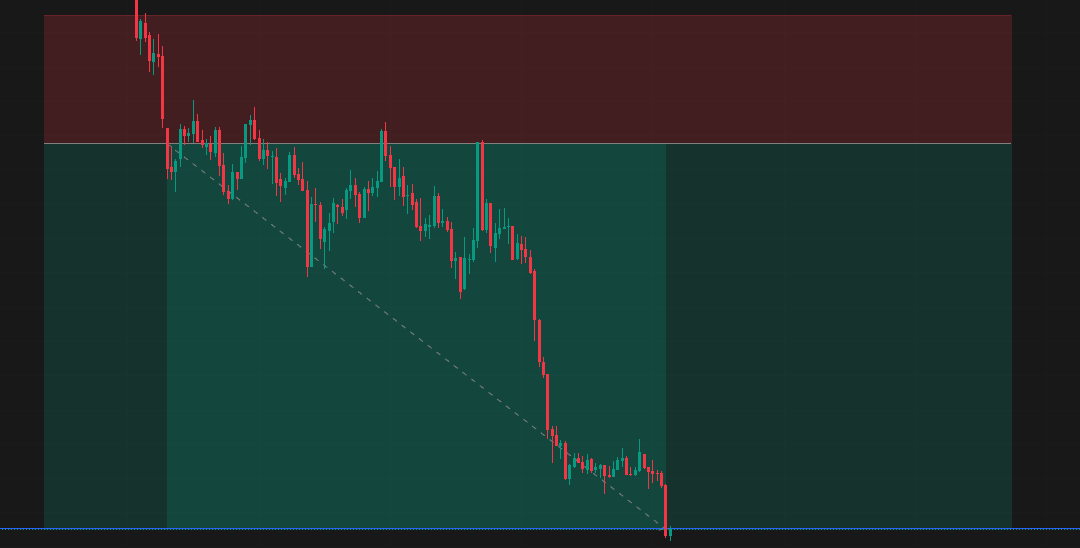

Losing Streak

A losing streak in trading involves consecutive losses, challenging a trader’s discipline, emotional control, and necessitating reevaluation of risk management

Psychological setback

A psychological setback in trading involves emotional strain, diminished confidence, stress management challenges, and the need for renewed focus and discipline.

Drawdowns

Drawdowns in trading represent the peak-to-trough decline in equity. It can lead to stress, eroded confidence, emotional trading, impaired judgment, burnout, fear, hesitation, and strategy tweaks.

Recent Trades

Discipline Tracker: Health + Finance

CAPITAL ACCOUNT

Recent Posts

Trading Psychology: How Discipline After a Stop Loss Delivered a 2.5R Trade

Trading Journal – Real Market Experience Trading is not just about finding the right setup. It is about executing the same process again and again,...

Trading Journal: Re-Entry, Risk-Reward Mistake, and Choosing Discipline Over Emotion

Market Context The market was trending during the session but showed sharp intraday reversals around key investor levels. This created multiple...

Intraday Trading Journal – Option Selling Strategy in a Trending Market

Today’s session was a good reminder that trending markets do not always move fast. Sometimes they move slowly, overlapping price, retesting levels,...

Data Feed Issues, Mental Pressure & a 2.5R Recovery Trade – Intraday Trading Journal

Market Overview The market consolidated during the early morning session and then attempted a reversal breakout to the upside. Considering the...